How to get Tax Refunds on Bluebird Card

One of the benefits of the American Express Bluebird card is the ability to get government benefits and payments direct deposited onto your card, including tax refunds. In this post, we will explain how to get your tax refunds on your Bluebird card.

This Post Will Cover:

-

- Bluebird Card Tax Refund Process

- How to get Tax Refunds on Bluebird Card

Bluebird Card Tax Refund Process

Here is how the Bluebird card tax refund process works:

You can get your tax refund faster when you Direct Deposit your federal tax refund into your Bluebird Account. Your tax refund will be added to your Account as soon as your return is processed and completed.

Here are the steps you need to take first before you can set up to get your tax refund on your Bluebird card.

Activate Bluebird Card Account

The first thing you need to do is to sign up for a Bluebird account. If you have a temporary Bluebird card, you need to register your card online and get a permanent Bluebird card. Your refunds cannot be deposited on a temporary Bluebird card.

If you don’t have a Bluebird card, you can sign up at the Bluebird website by following the step by step process under “How to Open a Bluebird Card Account” explained in this post.

Social Security Number Must Be on Returns

In order to avoid any delays in getting your tax refunds on Bluebird card, make sure your full name and social security number are listed first on your joint tax return.

That means that on your tax return, you should not be listed as “spouse”.

In addition, the name and social security number on your tax returns must match what Bluebird has on file. Otherwise, your tax refund could be rejected by Bluebird.

How to get Tax Refunds on Bluebird Card

Here’s how to set up your tax refund on your Bluebird card account.

Step 1 – Login to Bluebird Account

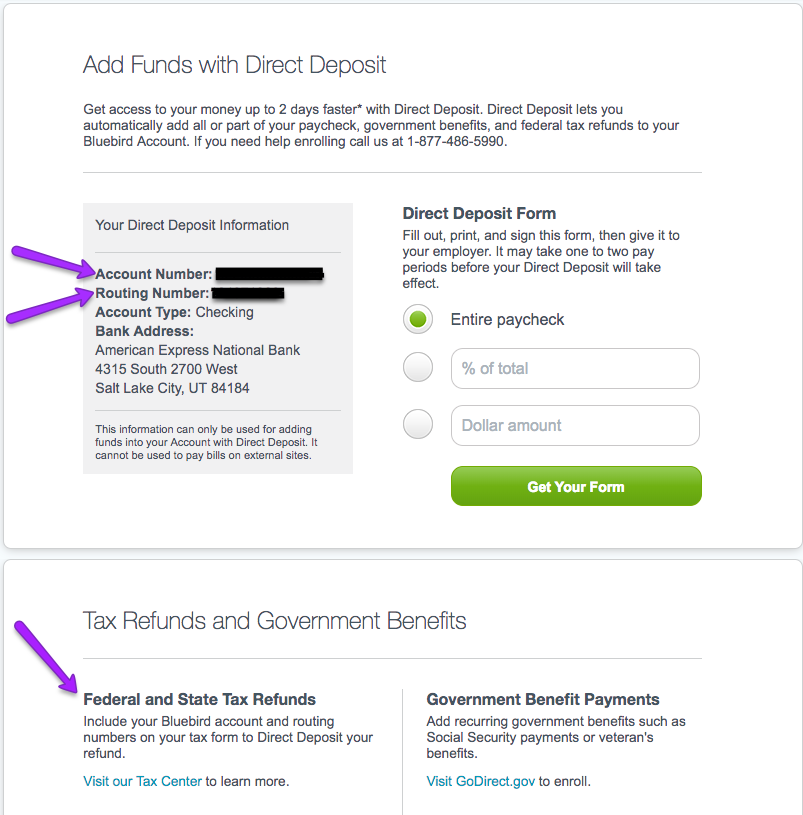

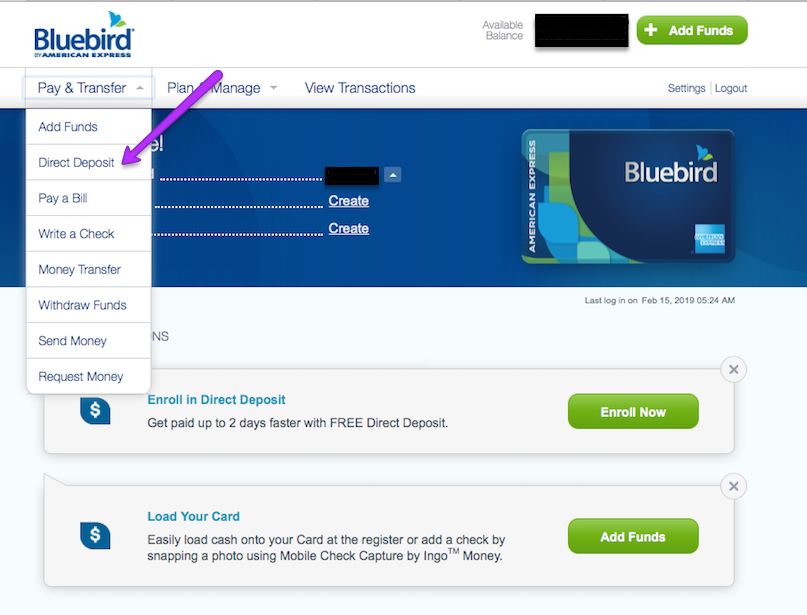

The first step to set up your Bluebird account to receive your tax refund is to log into your account. Once logged in, click on “Pay & Transfer” at the top of the page and select “Direct Deposit” from the menu as shown below:

You will be taken to a page that looks like the one below. Here, you will find your Bluebird account number and routing number listed – as shown by the arrows below. Write that information down as you will need it when you file your tax return.

Step 1 – File Your Tax Returns

When you file your tax returns, enter the Bluebird Account number and Bank Routing number found in step 1 above to your tax form. Select ‘Checking’ in the ‘Account Type’ box on your tax form (online or paper).

File your tax form as you normally would.

If everything has been entered correctly and the IRS accepts your tax returns, your refunds will be paid onto your Bluebird card.

To check the status of your refund, please visit the IRS website.

The video below provides a good summary on how to tax refunds on Bluebird card.

State Refunds on Bluebird Card

You can also get your state tax refunds deposited on your Bluebird card, as long as your state allows direct deposit of tax refunds. Please consult your state for instructions.

If you found our article on how to get tax refunds on Bluebird card helpful, please share it. If you have any questions about the Bluebird card, you can ask us in the comments section below.