American Express Bluebird Dispute Process

If you have a transaction on your Bluebird card you did not make or authorize, or if a transaction has been posted to your account for the wrong amount, you should contact the Bluebird Dispute Resolution Department. However, the feedback we have received from our readers is that the Bluebird dispute process is confusing and long.

In this post, we will explain the dispute process in detail, walking you through step by step on how to dispute a charge and what you need to successfully submit your request.

American Express Bluebird Dispute Process

Here are the steps you need to take to dispute a charge on your Bluebird card account:

Step 1

The first step in the Bluebird Dispute process is to determine if your request constitutes a legitimate error that needs to be investigated by the Dispute Resolution Department. This is important because not all transaction errors can be corrected by the Dispute Department.

There are issues that are best resolved directly with the Merchant and knowing which ones to contact Bluebird for will save you time and also help you get the issue resolved quickly and hopefully get any refunds you are due quickly.

Bluebird will investigate your dispute if it happened because an error occurred with a transfer or there is a transaction on your account that is:

- Not authorized by you

- Incorrectly posted to your Account

- Not properly reflected on your monthly statement

- A computational error (e.g. Transaction was for $32 but posted for $23)

- You did not receive the correct amount of funds (e.g., you requested $50 from an ATM but only received $40)

- You request documentation or additional information about a transaction

If you have an issue that does not constitute an error, then you will have to resolve that on your own with the merchant.

Issues Best Resolved with the Merchant

- A product was not delivered or service was not rendered, or

- The product or service is different than expected, or

- The product is defective, or

- A product was returned and you have not received a response from the merchant or credit to your account

Disputing a Charge That is Pending

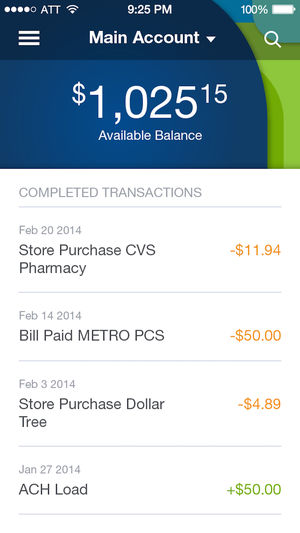

It is important to note that you cannot dispute a pending charge until it has posted to your account.

If you were reviewing your Bluebird account and found a suspicious transaction and would like to dispute that transaction, you have to make sure it is not in “Pending” status.

The reason for that is that pending charges are temporary and may change. Only posted transactions can be disputed. A transaction is considered posted if it does not have “pending” next to it, as shown below:

If you have any immediate concerns about a pending charge, you should contact the merchant responsible for the charge directly.

It can take a few days for pending transactions to post into your account. Once the transaction is no longer pending, you can initiate a dispute with Bluebird.

Step 2

Once you have determined that your issue is an error, the first thing you need to do is contact Bluebird customer service and submit a dispute request.

Here is what you will need to provide when you call Bluebird Customer Service:

- Your name and Bluebird Account number.

- Description of the transfer or transaction you are unsure about, and explanation of why you believe it is in error or why you need more information.

- The dollar amount and the date of the transaction you are disputing.

You can call Bluebird Customer Service at 1-877-486-5990, 24 hours a day, 7 days a week.

You have 60 days from the date of the transaction to file a request. Your dispute claim must include the information requested above in order for it to be valid.

Step 3

It is likely that customer service will ask you to also submit your dispute request in writing by mail.

If you are asked to send your dispute in writing, follow the instructions provided by the customer service agent over the phone.

It is important that you provide all the information requested in writing, including the ones listed above.

This will speed up the process. Any missing information will only delay the investigation and push back when you may likely get your money back.

Mail your dispute information to:

Bluebird Customer

Care P.O. Box 826

Fortson, GA 31808

You should probably track your mail to make sure it gets to Bluebird Customer Service.

You have 10 business days to submit the information requested to Bluebird by mail.

Provisional Credit to Your Account

Bluebird does not immediately issue a provisional (temporary) credit your account regarding the transaction you are disputing.

This is one policy that continues to frustrate many customers. That is because it denies them access to money they need right away.

Bluebird will only issue temporary credit to your account if they think your dispute is going to take more than 10 business days to investigate.

If your dispute will take more then 10 business days to investigate, they will issue your temporary credit within 10 business days AFTER receiving all the documents requested.

If they think your dispute can be investigated within the 10 business days, you will most likely NOT be issued a temporary credit.

How Long Does Dispute Process Take?

It takes them 10 business days (two weeks) to investigate most disputes after they have received your complete information.

Once the investigation is complete, it takes Bluebird (1) business day to correct any errors if the investigation showed that an error occurred.

Disputes that need more time can take up to 45 days for the investigation to be completed.

Disputes involving new Accounts, point-of-sale, or foreign-initiated transactions, we may take up to 90 days to investigate.

In addition, for new Accounts, it may take up to 20 business days (one month) to issue a temporary credit to your Account for the amount you believe is an error.

Step 4

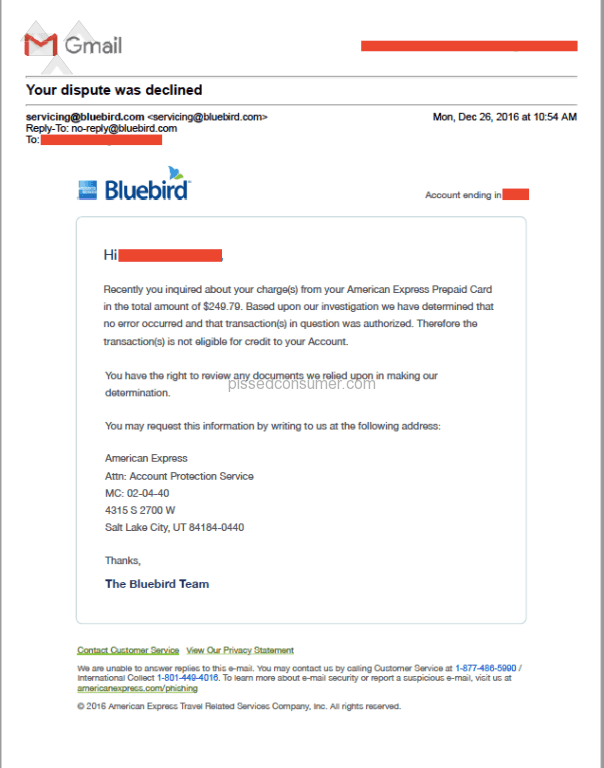

Once your issue has been investigated, Bluebird will communicate the results to you within 3 business days and fix any error that was discovered within one business day.

If they decide that there was no error in the transaction you are disputing, Bluebird will send you a written explanation, like the letter below:

If you were given a temporary credit and the results of the investigation do not conclude that there was an error, then the money that was credited to you will be debited back.

If you were given a temporary credit and the results of the investigation do not conclude that there was an error, then the money that was credited to you will be debited back.

We hope this article was helpful in explaining in detail dispute process with Bluebird.

If you have already gone through the Bluebird Dispute resolution process and would like to share your experience with other Bluebird cardholders, please do so in the comments section below.